If you’ve searched “80/20 rule in trading”, you’re probably trying to answer one question:

What should I focus on to improve faster — without overcomplicating my strategy?

The 80/20 rule (also called the Pareto principle) is a simple idea with huge impact: a small number of causes drive most of the outcomes.

In trading, that usually looks like this:

- A few setups generate most of your profits

- A few mistakes generate most of your losses

- A few hours/days of the week drive most of your best trades

- A few markets (or one!) match your style better than the rest

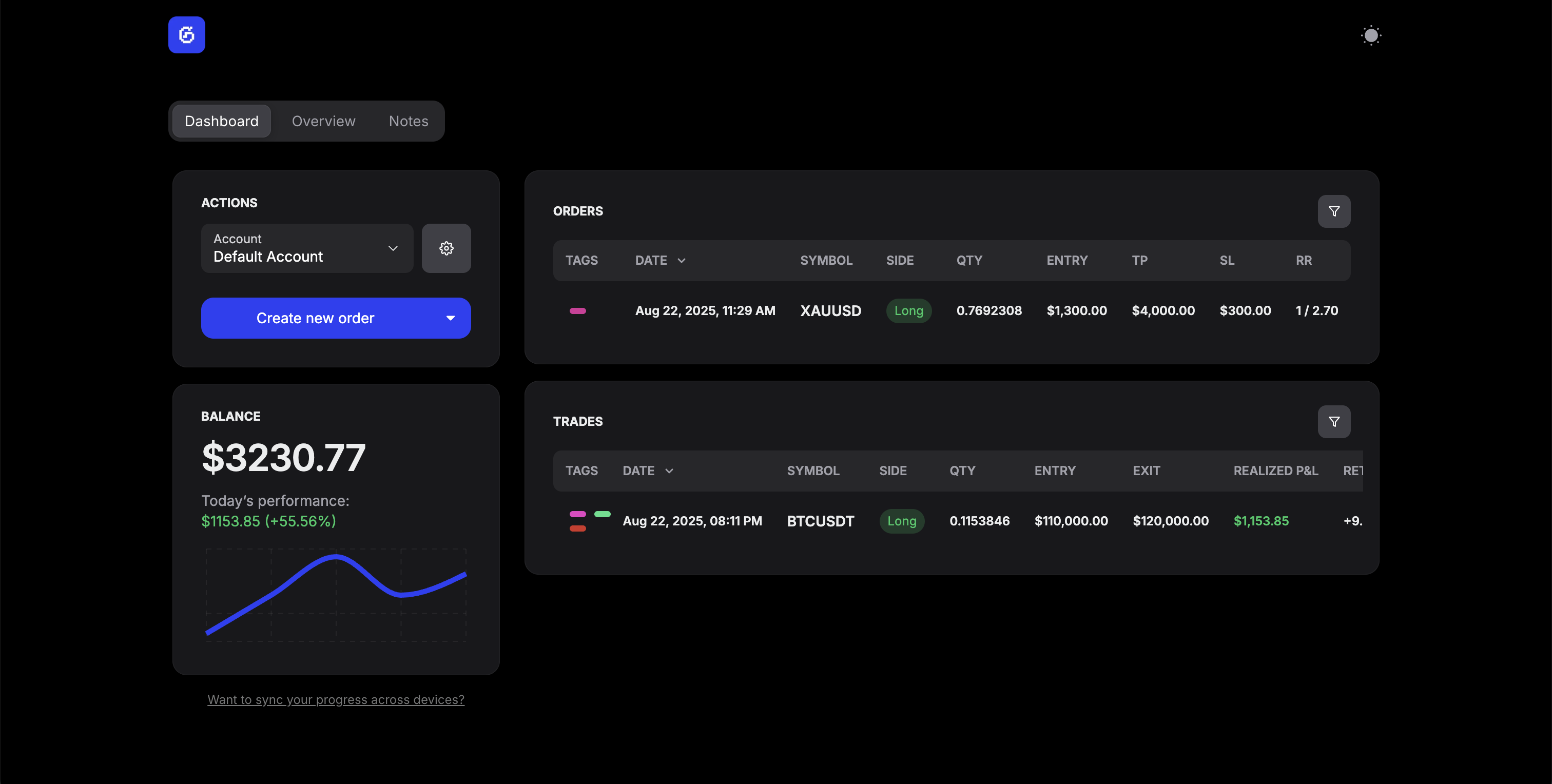

This guide shows how to apply the 80/20 rule to your trading process — and how to turn it into a repeatable review system using a trading journal like GASPNTRADER.

What Is the 80/20 Rule (Pareto Principle) in Trading?

The 80/20 rule says: roughly 80% of outcomes come from 20% of inputs.

It’s not a law of physics. The exact numbers might be 70/30 or 90/10. The value is in the mindset:

Stop treating everything as equally important. Find the “few” that matter most.

In trading, this becomes a performance question:

- Which trades produce most of my net P&L?

- Which trade types create most of my drawdowns?

- Which habit changes would improve results the fastest?

Why the 80/20 Rule Works So Well for Traders

Most traders fail from diffuse effort:

- too many indicators

- too many strategies

- too many markets

- too much noise

- not enough structured review

80/20 trading is the opposite:

- reduce chaos

- identify your edge

- double down on what works

- cut the biggest leaks first

The key benefit: better decisions with less mental load

When you know your “high-impact 20%,” you stop second-guessing every candle and start building a clear process.

A Practical 80/20 Checklist for Your Next Trading Review

Weekly (15–30 minutes)

- Identify top 3 profitable tags

- Identify top 3 losing tags

- Identify top 1–2 recurring mistakes

- Write 1 rule to scale, 1 rule to cut

Monthly (60–90 minutes)

- Compare performance by setup and market

- Review drawdowns and what caused them

- Decide what to stop doing next month

- Decide what to focus on next month

Conclusion: The 80/20 Rule Is a Trader’s Shortcut to Clarity

The 80/20 rule in trading is not a gimmick. It’s a way to replace randomness with focus:

- Find the few setups that actually work for you

- Find the few mistakes that actually hurt you

- Rebuild your process around those findings

- Repeat the review until your edge becomes obvious

If you want to apply Pareto thinking consistently, you need clean data and repeatable reviews — that’s exactly what a trading journal is for.

Start tracking, tagging, and reviewing inside GASPNTRADER — then let your own stats tell you what your “20%” really is.