Trading is as much a mental game as it is a financial one. Even skilled traders can make costly mistakes if they fail to manage their emotions. Emotional control in trading is critical for maintaining discipline, improving consistency, and maximizing profits.

In this article, we’ll explore how to control emotions in trading, including fear, greed, and impulsive decisions, while providing actionable techniques to strengthen your trading mindset.

Understanding Emotional Control in Trading

Emotional control in any market whether it's stock market or crypto, refers to the ability to regulate your feelings and reactions while making trading decisions. Traders who lack control often fall prey to emotional trading mistakes, such as overtrading or exiting positions prematurely. By mastering emotional regulation in trading, you can maintain a clear perspective and stick to your strategy.

Why Emotions Affect Trading Decisions

Fear and greed are the two primary emotions that influence trading outcomes:

- Fear – Can prevent taking calculated risks or cause early exits.

- Greed – Can lead to over-leveraging positions or chasing losses.

Understanding these emotions and recognizing triggers is the first step in controlling them.

How to Control Emotions While Trading

Develop a Solid Trading Plan & Track Your Trades

A well-defined trading plan and trading journal helps reduce emotional reactions. Include:

- Entry and exit rules

- Risk management strategies

- Daily or weekly profit targets

Having a plan ensures actions are driven by strategy rather than emotions.

Practice Day Trading Emotional Control

Day trading requires rapid decision-making, which can amplify emotional responses. Techniques include:

- Setting strict stop-loss and take-profit levels

- Avoiding trading during highly volatile news events unless planned

- Limiting daily trading sessions to reduce fatigue

Control Fear and Greed While Trading

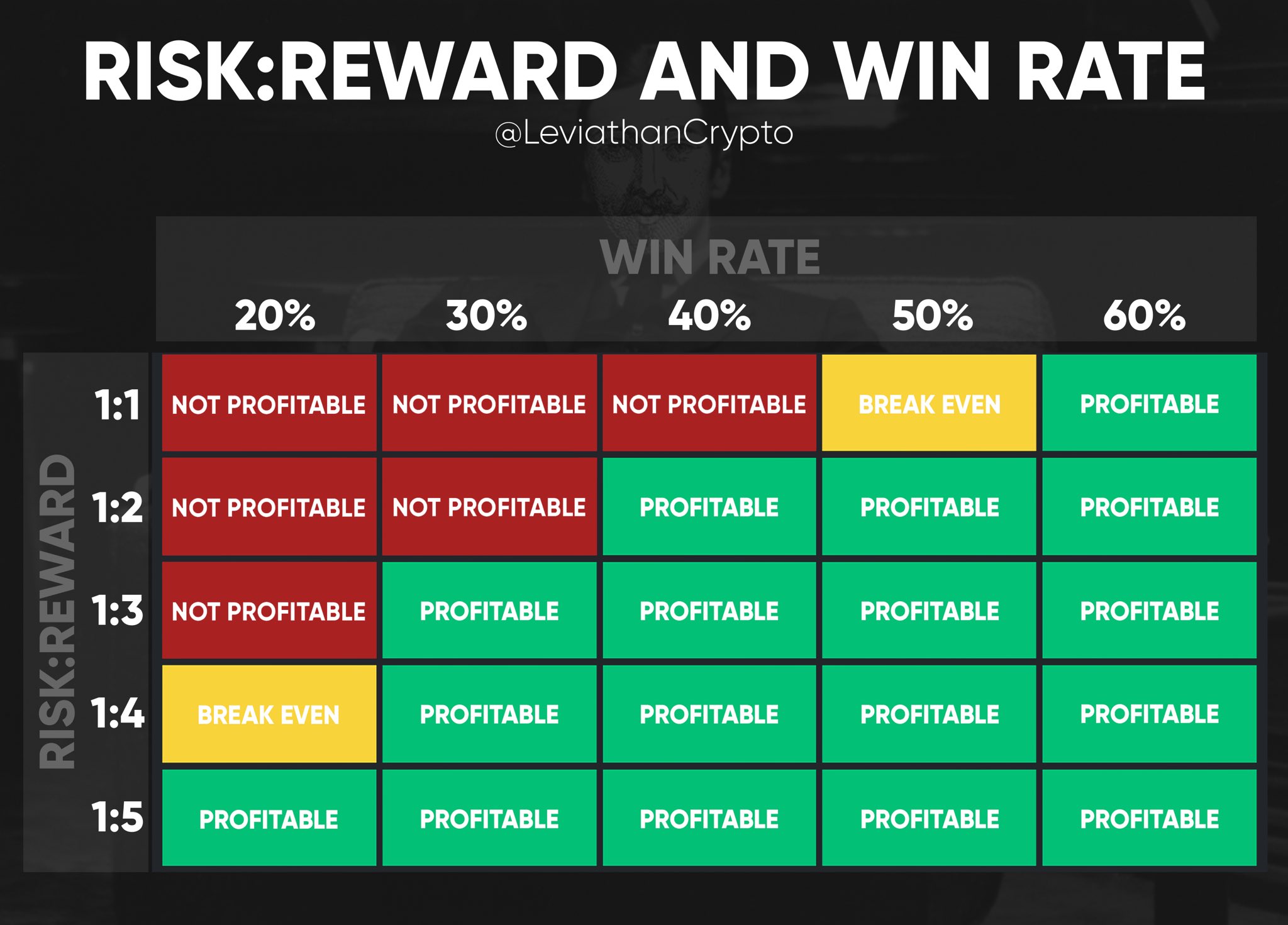

- How to Control Fear in Trading: Start with small positions, focus on risk-reward ratios, and accept that losses are part of the journey.

- How to Control Greed in Trading: Set realistic profit targets, avoid overtrading, and stick to your plan regardless of gains.

Emotional Control Techniques

Practical techniques to improve emotional regulation in trading:

- Mindfulness & Meditation – Stay calm and focused

- Journaling Trades – Track decisions and emotions to identify patterns

- Breaks and Timeouts – Prevent emotional escalation after losses

- Visualization – Mentally rehearse trades to reduce stress

Managing Trading Emotions with GASPNTRADER

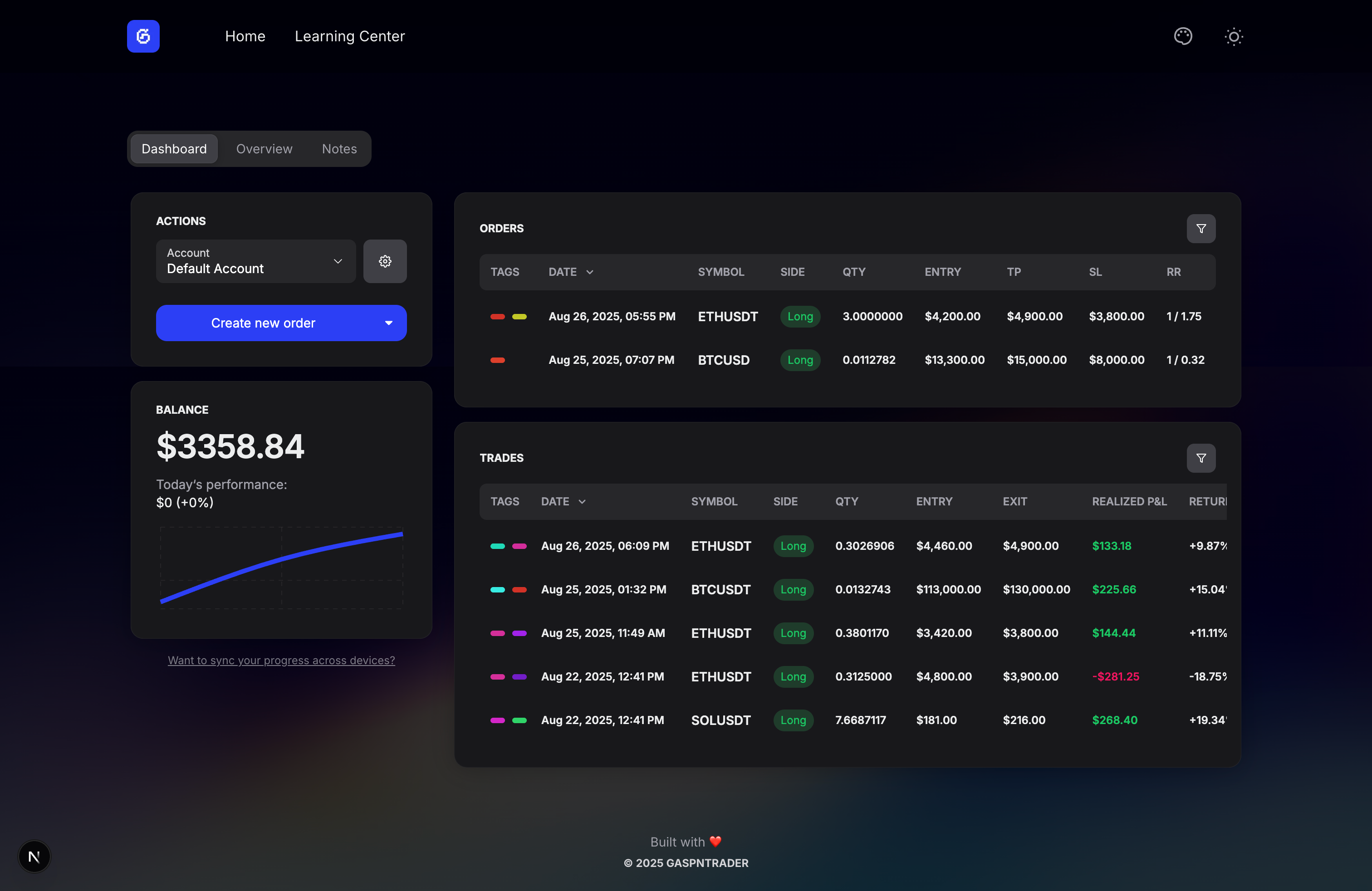

Dashboard for Real-Time Tracking

Track open and closed trades with detailed stats, helping reduce fear-driven decisions. Celebrate wins with visual cues 🎉 to reinforce positive habits.

Overview (Statistics) for Emotional Clarity

Access P&L summaries, win/loss ratios, and risk-reward statistics to gain objective insights. Clear data prevents overreacting to short-term market fluctuations.

Notes Section for Emotional Reflection

Attach notes and tags to trades for reflection and learning. Tracking emotional states helps improve emotional control in forex trading, crypto trading, or the share market.

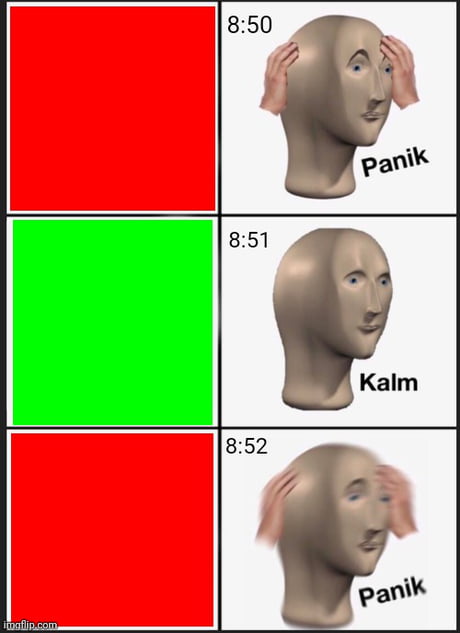

Example of Emotional Control in Trading

Imagine a trader noticing a sudden market dip. Instead of panic selling, they consult their plan, check risk levels, and place trades with calculated stops. They track everything in their trading journal, which helps them understand rationally how to behave in such situations. By controlling fear and greed in trading, they execute a profitable strategy while avoiding emotional trading mistakes.

On the other hand, another trader panics and sells without any analysis, letting fear dictate their decisions. This trader is more likely to repeat emotional trading mistakes, ultimately undermining their performance.

| Scenario | Trader A ✅ | Trader B ❌ |

|---|---|---|

| Market Event | Sudden market dip 📉 | Sudden market dip 📉 |

| Reaction | Consults trading plan | Panics and sells impulsively |

| Risk Management | Checks risk levels and places calculated stops | Ignores risk management |

| Journal Use | Logs trades and emotions in trading journal | Does not track trades or emotions |

| Outcome | Maintains rational behavior, executes profitable strategy | Repeats emotional mistakes, losses likely |

| Emotional Control | Fear and greed managed effectively | Fear dictates decisions |

| Long-term Impact | Improves discipline and consistency | Undermines performance and learning |

Trading Mindset Strategies for Long-Term Success

- Stick to your trading plan consistently

- Regularly review and analyze trades

- Limit exposure to high-volatility situations unless strategically justified

- Use tools like GASPNTRADER to reinforce objective decision-making

Conclusion

Controlling emotions while trading is essential for consistent success. By learning how to control fear and greed in trading, implementing practical emotional control techniques, and leveraging tools like GASPNTRADER, traders can improve discipline, avoid emotional trading mistakes, and maximize long-term profitability. Emotional control isn’t just a skill—it’s the foundation of trading mastery.