Keeping a trading journal is one of the most effective ways to become a profitable trader. It helps you track your performance, understand your strengths and weaknesses, and refine your strategy over time. The good news? You don’t need to pay for expensive software or subscriptions to get started. In this guide, you’ll learn how to start a trading journal for free and use it to improve your trading discipline and results.

Why a Trading Journal Matters

A trading journal is more than just a notebook of past trades—it’s a powerful learning tool. By recording your entries, exits, reasoning, and results, you’ll quickly notice patterns in your decision-making. This makes it easier to eliminate costly mistakes, manage risk better, and build a consistent trading strategy.

Step 1: Decide on Your Journal Format

There are multiple ways to keep a trading journal for free:

- Spreadsheets (Google Sheets, Excel or Notion): Flexible, customizable, and free to use, but it can be challenging to find a suitable template and set it up.

- Paper Notebook: Great for simplicity, but harder to analyze over time.

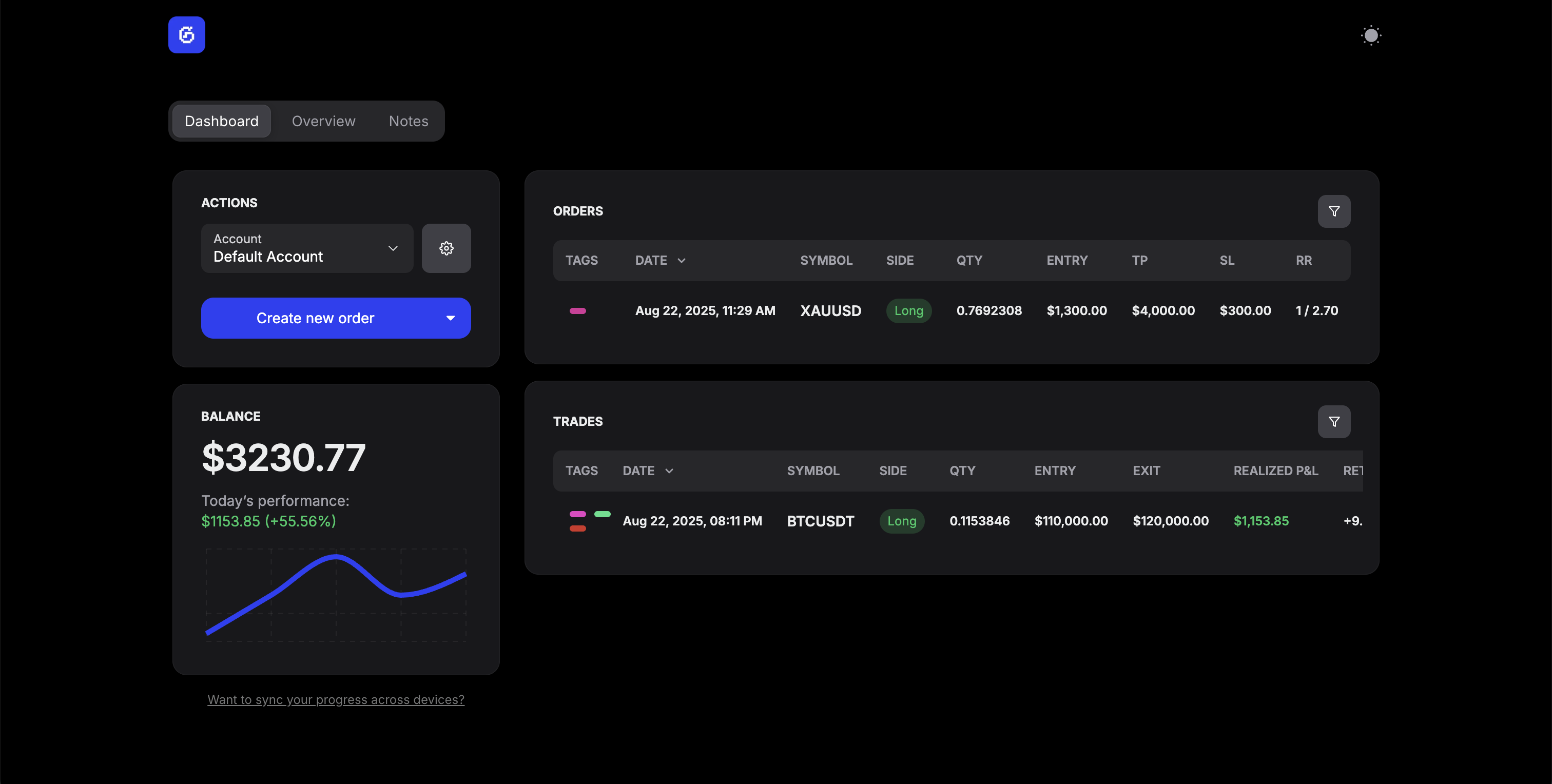

- Free Apps like GASPNTRADER: Designed specifically for journaling trades with no registration required, storing all your data securely in your browser.

👉 If you want instant access and modern features like charts and filtering, using a free trading journal app is the easiest option.

Step 2: Record Essential Trade Information

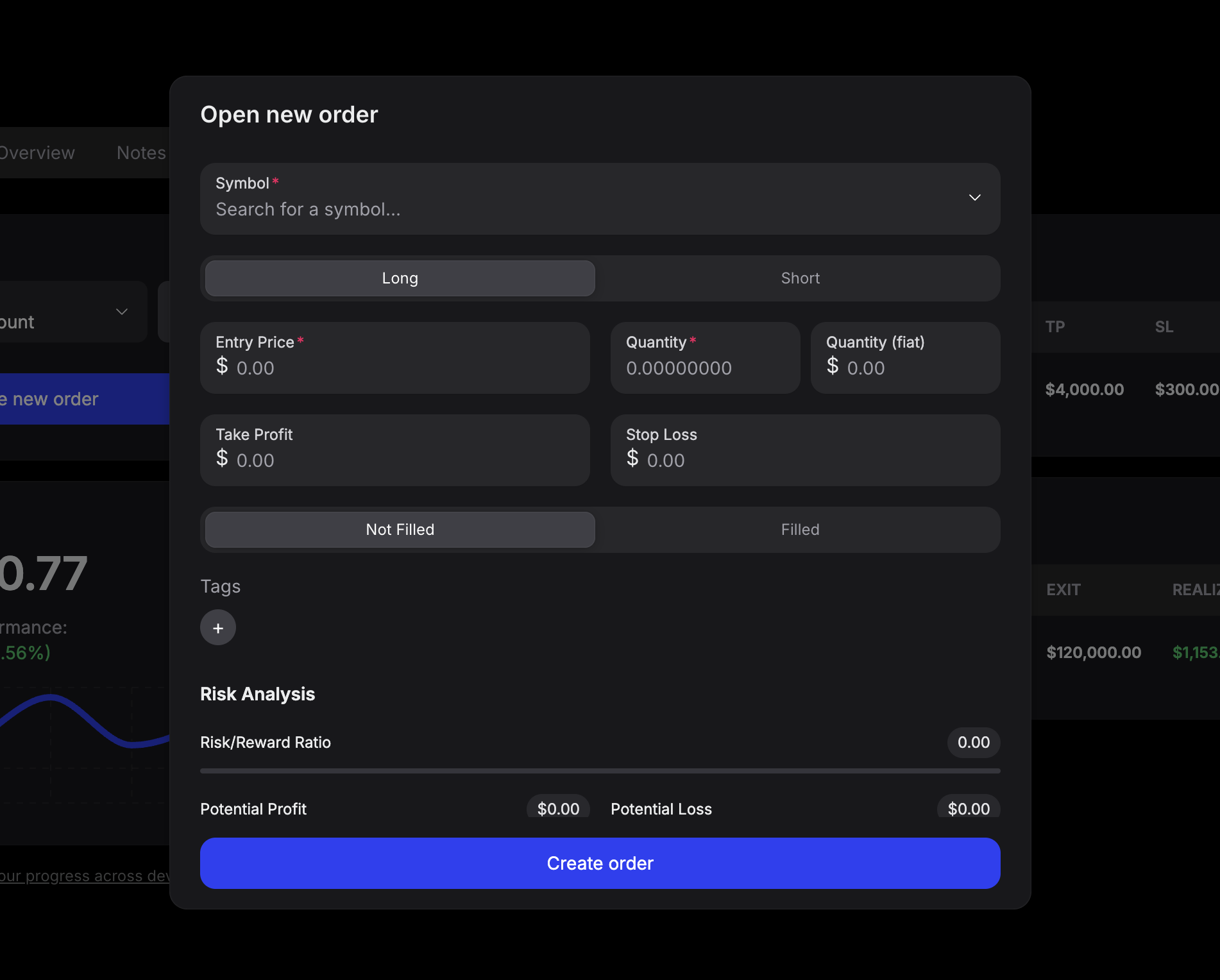

At a minimum, every trade entry should include:

- Date & Time

- Instrument / Pair (e.g., EUR/USD, AAPL, BTC/USDT)

- Entry & Exit Price

- Position Size

- Stop Loss / Take Profit

- Profit or Loss

- Reason for Trade (technical setup, news event, strategy)

- Emotions / Notes (were you confident, anxious, impulsive?)

The more detail you include, the more valuable your journal becomes when you review it later.

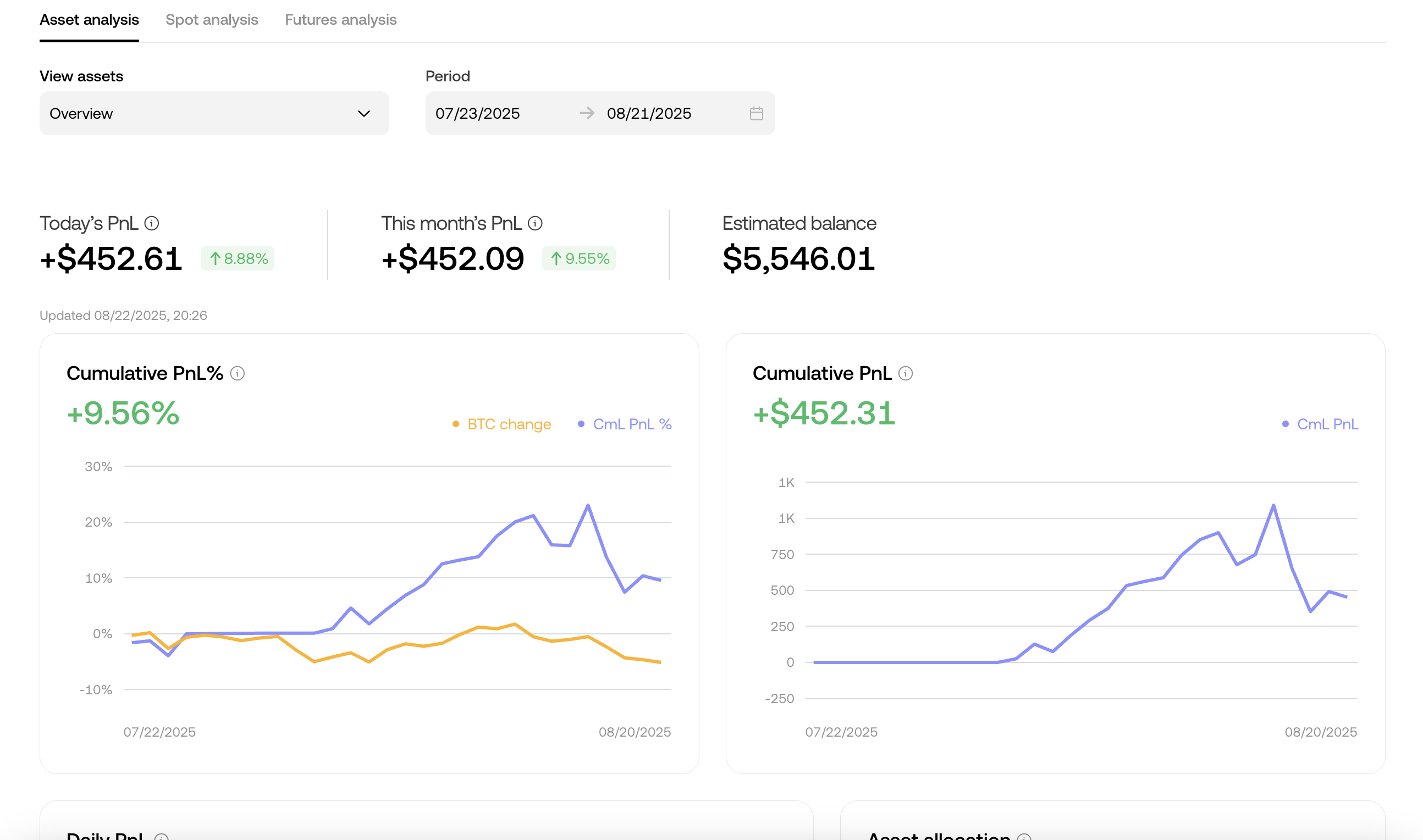

Step 3: Track Key Metrics

To grow as a trader, focus on important statistics such as:

- Win/Loss ratio

- Average profit vs. average loss

- Risk/Reward ratio

- Daily and monthly P&L

- Maximum drawdown

Free trading journal tools like GASPNTRADER automatically calculate these metrics for you, saving hours of manual work.

Step 4: Add Notes and Tags for Context

Numbers alone don’t tell the whole story. By adding personal notes and tags to your trades, you create context:

- “Overtraded after news release”

- “Followed breakout strategy”

- “Didn’t stick to stop-loss”

Later, you can filter trades by tag (e.g., “news trades”) to see whether that strategy is working for you.

Step 5: Review Regularly and Learn

The true power of a trading journal comes from regular review. At the end of each week or month:

- Look at your best and worst trades

- Check if you followed your rules

- Identify emotional triggers

- Adjust your strategy based on data, not feelings

This consistent reflection is what separates disciplined, profitable traders from those who continue making the same mistakes.

Conclusion

Starting a trading journal doesn’t have to be complicated or expensive. With the right structure, you can begin journaling your trades today for free. By consistently tracking performance, analyzing key metrics, and learning from past mistakes, you’ll develop the discipline and insights needed to trade profitably.