If you’ve ever tried converting crypto on Uniswap or PanckageSwap and saw the message “Not enough liquidity to convert,” you’re not alone.

This is one of the most common — and confusing — issues for both new and experienced traders. It’s directly tied to market liquidity and slippage, two key factors that determine how efficiently you can buy or sell digital assets.

In this article, we’ll explore what low liquidity means, why conversions fail, and how tools like GASPNTRADER can help you analyze and avoid liquidity-related mistakes.

What Is Liquidity in Crypto?

Liquidity refers to how easily an asset can be converted into another — typically fiat or a stablecoin — without causing major price changes.

In simple terms, it’s about how deep the market is.

- High liquidity = many buyers and sellers, tight spreads, fast conversions.

- Low liquidity = few participants, wide spreads, and price slippage.

Crypto Low Liquidity Meaning

When a coin is said to have low liquidity, it means that even a small buy or sell order can move the price significantly.

This usually happens with new, less popular, or thinly traded cryptocurrencies.

Why You Get “Not Enough Liquidity to Convert”

The error occurs when your exchange can’t find enough counterparties to fulfill your conversion at or near the market price. Here’s why that happens:

1. Low Trading Volume

If a token trades infrequently, there may not be enough buy/sell orders to match your conversion size.

2. Exchange Restrictions

Some of regional platforms have fewer traders than global ones, reducing available liquidity pools.

3. Thin Order Books

A shallow order book means small amounts of liquidity at each price level.

If you try to sell more than available, the conversion fails.

4. Sudden Market Movements

Extreme volatility (like after news events) can make liquidity evaporate temporarily — even on large exchanges.

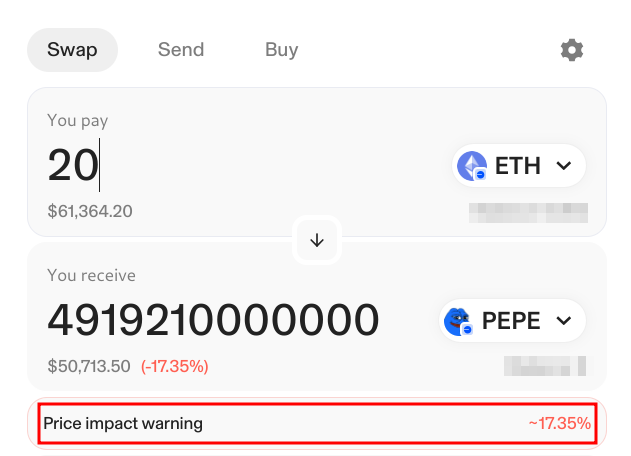

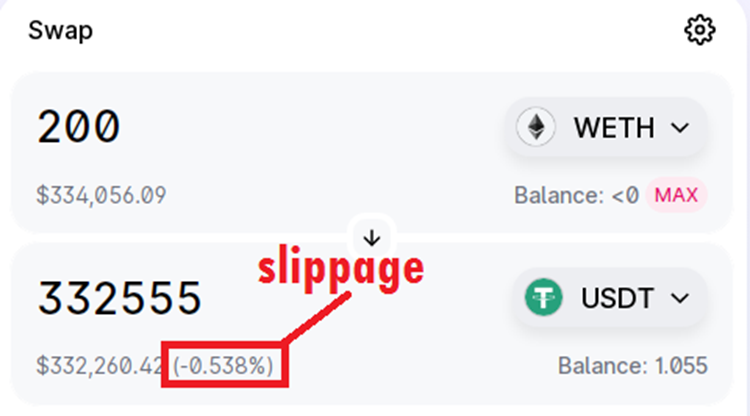

Understanding Slippage: The Hidden Cost of Low Liquidity

Slippage is the difference between the expected and actual execution price.

It increases when trading in illiquid markets, where large orders “walk” through multiple price levels before completion.

Example:

You place a sell order at $1.00, but only half fills there — the rest sells at $0.97.

That $0.03 gap is slippage caused by insufficient liquidity.

Can You Sell Crypto with Low Liquidity?

Technically yes — but not always efficiently.

Here’s what to consider before attempting to sell crypto with low liquidity:

| Risk | Description | Mitigation |

|---|---|---|

| Wide spreads | Difference between bid and ask prices widens | Use limit orders |

| Partial fills | Only part of your trade executes | Break trades into smaller chunks |

| Price impact | Your trade moves the market | Avoid illiquid pairs |

| Conversion failure | Exchange can’t complete transaction | Try a major intermediary like USDT or BTC |

Practical Tip

Instead of converting directly (e.g., small altcoin → USD), first swap into a liquid pair like BTC/USDT, then convert to fiat.

Do Crypto Assets Have Low Liquidity?

It depends.

- Large-cap assets like BTC and ETH have deep order books and global demand.

- Small or new cryptocurrencies often suffer from low liquidity — especially right after listing.

Do New Cryptocurrencies Have Low Liquidity?

Yes, early-stage tokens usually trade in limited markets with few participants.

This increases both conversion risk and slippage.

How GASPNTRADER Helps Manage Liquidity and Slippage Risks

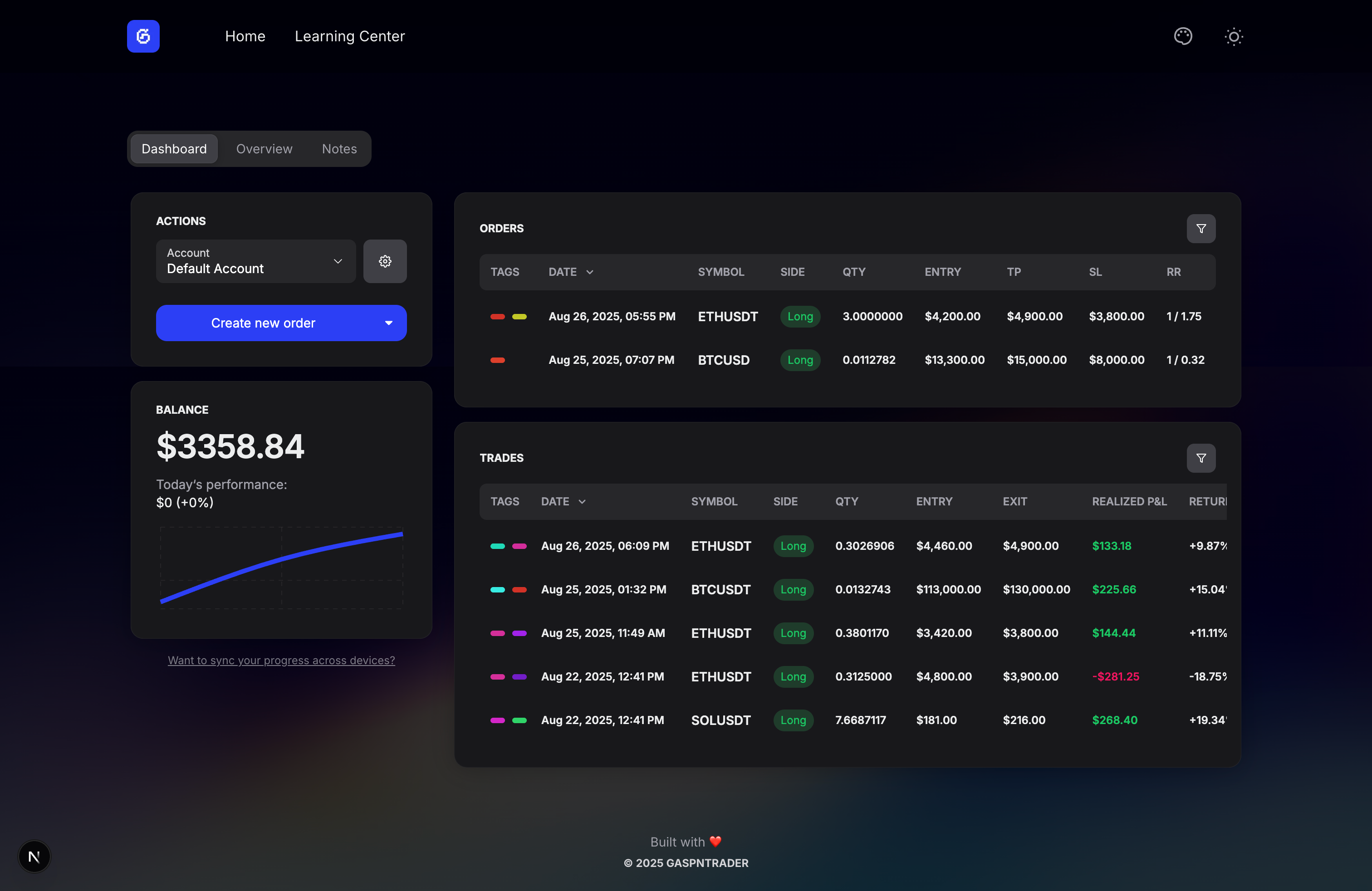

GASPNTRADER is a free, modern trading journal designed to give you clarity over your executions — including those affected by low liquidity.

Track and Tag Low-Liquidity Trades

Tag trades where conversions failed or experienced high slippage.

Visualize patterns over time to see which assets consistently cause problems.

Measure Execution Quality

Compare expected vs. actual fill prices to quantify slippage and identify weak exchanges or pairs.

How to Avoid “Not Enough Liquidity” Errors

Follow these actionable steps to reduce the chance of failed conversions:

- Trade during high-volume sessions — overlaps between U.S. and EU hours are best.

- Use limit orders, not instant conversions.

- Avoid obscure altcoins with tiny daily volume.

- Check exchange depth charts before large orders.

- Track slippage and liquidity in GASPNTRADER to refine your trade timing and sizing.

Final Thoughts

The “Not enough liquidity to convert” message isn’t a glitch — it’s a market signal.

It reminds traders that liquidity, not just price, determines whether trades execute efficiently.

By understanding liquidity mechanics, monitoring slippage, and journaling your performance in GASPNTRADER, you can protect your capital, improve trade timing, and avoid costly surprises.

Smart traders don’t just chase profits — they manage liquidity risk.